Table of Content

- How much does a Home Equity Loan Processor make?

- Looking for a job?

- Mortgage Loan Originator - Arlington, VA

- What is the growth rate of the Home Loan Processor's salary?

- What Type Of Loan Processor Gets Paid The Most?

- Average Total Cash Compensation

- Loan Processor Related Careers

- Home Equity and Consumer Loan Processor

This will ensure you have enough money for your living expenses. Under certain conditions, it is also possible to finance a property without equity. These include, for example, a very good credit rating, a very high income, and an excellent location of the property. However, the bank will charge significantly higher interest. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders.

To find the right mortgage, there are some points you should consider. For example, it is advisable to plan the mortgage, so you have paid it off by the time you retire. Also, keep in mind that you usually need to pay the additional purchase costs yourself. However, it is possible to take out a separate personal loan for this purpose. Furthermore, your monthly repayment should be calculated realistically, so you can easily cover it without having to restrict your accustomed standard of living.

How much does a Home Equity Loan Processor make?

We will begin by asking you several key questions, which will help us determine which mortgage products could work best for you. A fixation period which is too short could cause you financial hardship if interest rates go up significantly in the future. However, too long a fixation period could result in high costs, inflexibility, or exorbitant cancellation fees if you move on early. Hypofriend’s Optimization Engine will recommend the optimal fixed interest period for your situation.

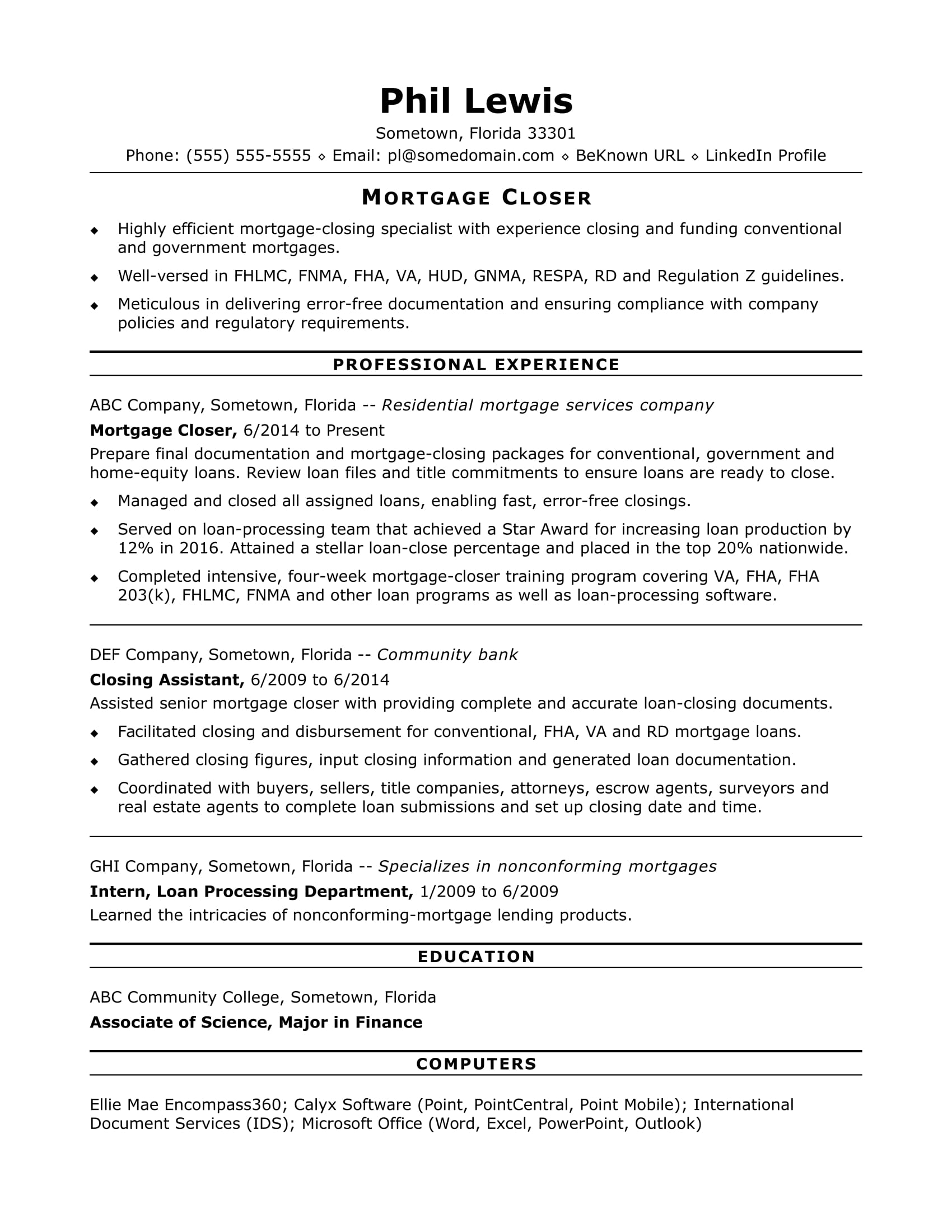

If you are thinking of becoming a Mortgage Loan Processor or planning the next step in your career, find details about the role, the career path and salary trajectory of a Mortgage Loan Processor. If you are thinking of becoming a Home Equity Loan Processor or planning the next step in your career, find details about the role, the career path and salary trajectory of a Home Equity Loan Processor. Besides the location, employees' education degree, related skills, and work experience also will influence the salary.

Looking for a job?

However, our calculator does not replace a personal consultation. Use the calculator to understand your mortgage repayment options. The salary range for a loan processor in Farmington, NM is from $26,000 to $52,000 per year, or $13 to $25 per hour. The darker areas on the map show where loan processors earn the highest salaries across all 50 states. Below is the total pay for the top 10 highest paying companies for a Mortgage Loan Processor in United States. Like many mortgage brokers, we get paid by the German lender banks.

From the first touchpoint, they guided us through step by step and answered our overwhelming amounts of questions. Compare the average loan processor salary history for individual cities or states with the national average. These charts show the average base salary , as well as the average total cash compensation for the job of Loan Processor in the United States. The base salary for Loan Processor ranges from $36,362 to $45,652 with the average base salary of $40,692. The total cash compensation, which includes base, and annual incentives, can vary anywhere from $37,825 to $47,654 with the average total cash compensation of $42,491.

Mortgage Loan Originator - Arlington, VA

You know if you are being paid fairly as a Loan Processor if your pay is close to the average pay for the state you live in. For example, if you live in California you should be paid close to $45,801 per year. Compare salaries for individual cities or states with the national average. Mortgage processors streamline the mortgage loan process by compiling loan application documentation for the borrower. The average salary for Home Loan Processor is $49,540 per year in the United States.

However, they do not represent a financing proposal or a financing confirmation. For us to find the optimal mortgage for you, we need to know your personal financial situation. Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer. The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. Particularly long fixed interest rates are usually higher.

What is the growth rate of the Home Loan Processor's salary?

Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. In your secure online account, you can easily upload your required personal, property and mortgage documents to get approved faster than traditional brokers. Your personal mortgage expert will support you to review and understand all your options. Banks in Germany like safety and are interested in you paying back the mortgage. That is why banks in Germany are so strict about approving a mortgage. Our engine combines modern finance theory with practical insights from our team of mortgage brokers.

This chart shows how loan processor salaries compare at nearby companies. To view companies in a different region, use the location filter below to select a city or state. The highest paying companies for loan processors are Stanford University and BNP Paribas according to our most recent salary estimates.

Needs to review the security of your connection before proceeding. If you are thinking of becoming a Home Loan Processor or planning the next step in your career, find the detailed salary report of a Home Loan Processor. While the loan officer or broker may be the person who “got you the loan” to begin with, it’s the processor that will likely take over once you’ve been “sold.”. Once you've selected your mortgage offer, we will provide you a document checklist that shows all the required document you need to submit.

Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan. However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call. With a short fixed interest rate period, on the other hand, you benefit from a lower interest rate. But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it.

The average salary for a Professor is €87,480 per year in Hesse. Salaries estimates are based on 15 salaries submitted anonymously to Glassdoor by a Professor employees in Hesse. Nevertheless, our mortgage calculator is a good start in your search for the best mortgage. In the next step, our financing experts will discuss your financing options with you during a free, no-obligation online consultation, taking into account your situation, wants, and needs. The more equity or savings you bring in, the lower your loan-to-value ratio LTV and hence the interest rate at which the bank grants you your mortgage. Typically, banks lower the interest rate gradually in 5% steps of the LTV.

In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV. Factors such as company type and location impact how much an entry-level loan processor can make. While many factors affect earning potential for loan processors, location is a major influence. Loan processors can make 16% more living in San Francisco, Santa Clara, and Washington D.C. A loan processor's average annual salary is $41,782 or $20.09 per hour.

Mortgage lendersto reduce time and optimise the mortgage loan experience. As a rule, your savings must cover the additional purchase costs. Depending on the state, this is between 9% and 12% of the purchase price of the property. The amount of equity required cannot be answered in general terms. The results of the mortgage calculator give you a first impression of your mortgage possibilities and help you to get orientated. It is a sample calculation that shows an overview of your expected costs.

Try to improve your skills and experience to get a higher salary for the position of Home Loan Processor. The Home Loan Processor salary range is from $42,806 to $57,826, and the average Home Loan Processor salary is $49,540/year in the United States. The Home Loan Processor's salary will change in different locations.

No comments:

Post a Comment